The Foreign Subsidy Regulation (‘FSR’) is applicable in the EU from 12 July 2023. It introduces a control regime for foreign subsidies, with a view to address distortions caused by such subsidies on the internal market and to ensure a level playing field.

In short, the FSR requires notification to and prior approval from the European Commission (’Commission’) of concentrations (mergers, acquisitions and creation of JVs) and public procurement procedures meeting set out thresholds. In addition, the Commission will be able to examine alleged foreign subsidies on its own initiative (ex officio investigations) which includes investigations of already implemented concentrations, and it will further be able to require notification of concentrations not meeting the thresholds (ad hoc notifications), if it suspects that foreign subsidies have been granted to the undertakings concerned in the three years prior to the concentration.

This article focuses on the FSR’s application with regard to concentrations, aiming to help undertakings prepare their organisation on the basis of currently available information. As the legislation is new, there is unfortunately no Commission practice or EU Court of Justice case law to lean on and Commission guidelines are not expected any time soon.

Below is a short description of the main elements of the FSR as regards concentrations and in the annex, we propose a check list, as a help in the preparations.

A concentration shall be notified to the Commission if the following thresholds are met:

The two notification procedures and the ex officio investigations are triggered by non-EU financial contributions provided, directly or indirectly, by non-EU public authorities or public or private entities whose actions can be attributed to a non-EU country. ‘Financial contribution’ is a deliberately wide term including e.g. capital injections, grants, loans, guarantees, tax exemptions and even the provision or purchase of goods/services.

A financial contribution constitutes a foreign subsidy if it confers a benefit on an undertaking engaged in an economic activity in the EU and if it is limited to one or more undertakings or industries. It is the Commission alone who determines whether a financial contribution constitutes a foreign subsidy or not, and who will assess whether a foreign subsidy distorts the EU internal market.

For the aggregation of foreign financial contributions, a notifying party will have to include every de facto controlled company in its group in the monitoring of financial contributions. This includes all entities that are solely or jointly, directly or indirectly, controlled by the acquirer, all entities or persons that solely or jointly, directly or indirectly, control the acquirer, and entities also controlled by the entities controlling the acquirer. For investment funds this includes contributions received by other funds managed by the same investment company and their respective portfolio companies and subsidiaries. Note that there are certain exceptions applicable to investment funds in the notification form, which will ease their administrative burden in terms of a notification.

As for the target company, the aggregation shall include the target itself and any entities controlled by it. The seller is thus excluded.

Concentrations for which the agreement was concluded, the public bid announced, or a controlling interest was acquired before 12 July 2023 are not covered by the FSR.

The notification obligation is applicable as of 12 October 2023. Notifiable concentrations for which the conclusion of the agreement, the public bid announced, or the acquisition of a controlling interest takes place on or after 12 July 2023, which are not closed before 12 October 2023, will have to be notified. If a transaction which is signed after 12 July 2023 risks not being closed before 12 October, a notification should be prepared.

The Commission may decide to open an ex officio investigation already as of 12 July 2023, in which case it can investigate foreign subsidies granted as far back as 12 July 2018. There are indications that a number of EU companies are in the starting blocks to submit FSR complaints to the Commission. Such complaints could allow the Commission to open an ex officio investigation.

The Commission adopted an implementing regulation on 10 July 2023, setting out procedural provisions and notification forms for procedures pursuant to the FSR. The first sections of the notification form concern general information about the transaction and the parties involved.

As to the foreign financial contributions, the implementing regulation unfortunately leaves many notions open to interpretation and only to a certain extent limit companies’ burden to submit information and documentation. Below, we mention just a few of the requirements set out in the notification form for concentrations.

In line with the FSR, the notification form requires a notifying undertaking to provide a detailed list of all financial contributions provided by a non-EU country equal to or in excess of EUR 1 million that may fall into the category described in the FSR as “most likely to distort the internal market” (e.g. aid to ailing undertakings, unlimited guarantees for debts or liabilities, export financing measures not officially supported by the OECD, subsidies directly facilitating a concentration), which have been granted in the three years prior to the conclusion of the agreement, the announcement of the public bid or the acquisition of a controlling interest.

For financial contributions that may fall into any of those categories, the main elements, characteristics, and form of contribution must be specified, together with the purpose and economic rationale, conditions attached and whether the contribution confers a benefit and whether it is selective. The last two are concepts of EU State aid law which may be difficult for companies to apply.

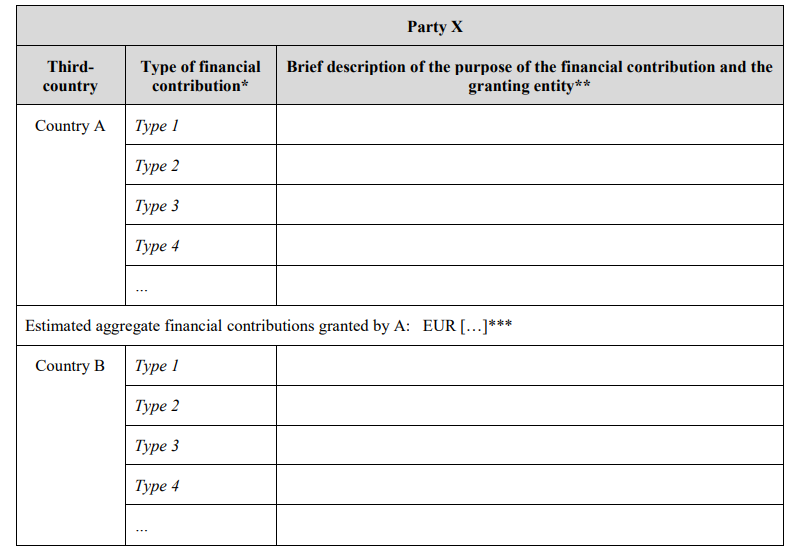

Information on foreign financial contributions equal to or in excess of EUR 1 million granted to the notifying parties in the three years prior to the conclusion of the agreement or the announcement of the public bid, which do not fall into the categories of contributions most likely to distort the internal market, may be provided in the form of a simplified overview (see Table 1, below).

As to the impact on the internal market, for example, if a structured bidding process is carried out, the notification shall include a detailed description of the process and how the financial contributions most likely to distort the internal market may improve the competitive position in the EU of the parties to the transaction. Further, analyses, reports, studies discussing the purpose and economic rationale of contributions most likely to distort the internal market prepared by or for or received by any member of the board of management, the board of directors or the supervisory board, as well as copies of reports on due diligence carried out by external advisors shall be provided as supportive documentation.

Nevertheless, the notification form does provide for the possibility for a notifying party to request a waiver from the obligation to provide information if it is not reasonably available to the notifying party in part or in whole. Such a request must be made in a draft notification during pre-notification contacts.

With regard to the information required, it is clear that companies are facing a very burdensome administrative exercise, monitoring and gathering information and documentation potentially relevant to future FSR proceedings. The FSR will thus have important implications for current and future deal planning (e.g. transaction timeline, including preparation time, duration of pre-notification and time required for a notification to be considered complete). It will also be necessary to consider liability clauses, conditions precedent and provisions on risk-sharing.

If a transaction must be notified, the Commission’s approval is required prior to closing (standstill). The FSR provides for fines of up to 1 % of aggregate turnover in the preceding year for incorrect or misleading information, and up to 10 % of aggregate turnover for failure to notify a notifiable concentration.

Does your company or any entity of your corporate group interact with public authorities in third countries or public or private entities whose action can be attributed to the third country; and is it likely or plausible that your company or corporate group will be involved in M&A, transactions, whether as acquirer or seller, potentially triggering mandatory notification? Are your competitors likely to submit complaints to the Commission about you having received foreign subsidies? If the answer to any of these questions is yes, we advise you to set up a system for continuous monitoring of non-EU financial contributions throughout your organisation.

In order to single out the foreign financial contributions, i.e. those provided by non-EU countries, companies must identify every economic interaction they undertake, then identify the counterpart involved in the interaction and assess whether this counterpart is an entity whose actions may be attributed a non-EU government,

For the purpose of potential notifications, the monitoring system should list all foreign financial contributions received after 12 July 2020. No matter the amount, all foreign financial contributions received shall be taken into account for the aggregation necessary to determine whether the threshold of EUR 50 million is met and a notification is triggered. The system should preferably flag contributions of EUR 1 million or more, in order to facilitate a potential notification..

Note that, according to the FSR, a foreign subsidy is not considered to distort competition if its total amount is below EUR 200,000 per non-EU country during a consecutive period of three years. However, financial contributions of less than EUR 200,000 are relevant for the aggregation of foreign financial contributions and the Commission may request information thereof in the context of a notification or in an ex officio investigation. Such investigations may be started in relation to foreign subsidies provided as of 12 July 2018. It may thus be of interest to track financial contributions received as of that date, if the Commission is likely to investigate any of your M&A transactions signed after 12 July 2023.

The monitoring system should include, for each identified financial contribution, information on amount, granting date, receiving entity, granting entity, granting country, type of financial contribution and should indicate whether a contribution falls into any of the categories most likely to distort the internal market, namely: aid to ailing undertakings, unlimited guarantees for debts or liabilities, export financing measures not officially supported by the OECD, subsidies directly facilitating a concentration.,

The monitoring system should be continuously updated, by all entities of the corporate group.

The monitoring system should include descriptions of possible positive effects on the development of the relevant subsidised economic activity on the EU internal market, as well as broader positive effects on relevant policy objectives, in particular those of the EU. Specify when and where the positive effects have/are to take place.

When a transaction is notified under the FSR, there is a requirement to provide supporting documentation relating to non-EU financial contributions falling within the categories most likely to distort the EU internal market. This includes information on the form, purpose, economic rationale, granting authority, conditions attached, benefit conferred and selectivity of the contribution.

There is also a general requirement to provide documents (analyses, reports, studies, etc.) from the grantor or beneficiary, discussing the purpose and economic rationale of the contribution as well as possible positive effects.

The monitoring system should, as relevant, include this information and/or sources to such supportive documentation.

Table 1 to Annex 1 of the Commission’s Implementing Regulation, the simplified overview.

(*) Identify the financial contributions grouping them by type: such as direct grant, loan/financing instrument/repayable advances, tax advantage, guarantee, risk capital instrument, equity intervention, debt write-off, contributions provided for the non-economic activities of an undertaking (see recital 16 of Regulation 2022/2560), or other.

(**) General description of the purpose of the financial contributions included in each type and of the granting entity(ies). For instance, ‘tax exemption for the production of product A and R&D activities’, ‘several loans with State-owned banks for purpose X’, ‘several financing measures with State investment agencies to cover operating expenses / for R&D activities’, ‘public capital injection in Company X’.

(***) Use the following ranges: ‘EUR 45-100 million”, “EUR >100-500 million”, “EUR >500-1 000 million”, “more than EUR 1 000 million”.

The EU Foreign Subsidies Regulation – M&A transactions – How to prepare? (PDF)