The Foreign Subsidy Regulation (‘FSR’) is applicable in the EU from 12 July 2023. It introduces a control regime for foreign subsidies, with a view to address distortions caused by such subsidies on the internal market and to ensure a level playing field.

In short, the FSR requires notification to and prior approval from the European Commission (‘Commission’) in relation to concentrations (mergers, acquisitions and creation of JVs) and public procurement procedures meeting set out thresholds. In addition, the Commission will be able to examine alleged foreign subsidies on its own initiative (ex officio investigations) which includes investigations of already implemented concentrations, and it will further be able to require notification of concentrations not meeting the thresholds (ad hoc notifications), if it suspects that foreign subsidies have been granted to the undertakings concerned in the three years prior to the concentration.

This article focuses on the FSR’s application with regard to concentrations, aiming to help undertakings prepare their organisation on the basis of currently available information. As the legislation is new, there is unfortunately no Commission practice or EU Court of Justice case law to lean on and Commission guidelines are not expected any time soon.

Below is a short description of the main elements of the FSR as regards concentrations and in the annex we propose a check list, as a help in the preparations.

Thresholds triggering the notification obligation

A concentration shall be notified to the Commission if the following thresholds are met:

Financial contribution v. foreign subsidy

The two notification procedures and the ex officio investigations are triggered by non-EU financial contributions provided, directly or indirectly, by non-EU public authorities or public or private entities whose actions can be attributed to a non-EU country. ‘Financial contribution’ is a deliberately wide term including e.g. capital injections, grants, loans, guarantees, tax exemptions and even the provision or purchase of goods/services.

A financial contribution constitutes a foreign subsidy if it confers a benefit on an undertaking engaged in an economic activity in the EU and if it is limited to one or more undertakings or industries. It is the Commission alone who determines whether a financial contribution constitutes a foreign subsidy or not, and who will assess whether a foreign subsidy distorts the EU internal market.

Relevant beneficiaries of financial contributions

Corporate groups will have to include every company in the group in the monitoring of financial contributions. For private equity investors this includes contributions received by the different funds and respective portfolio companies with subsidiaries.

Relevant dates

Concentrations for which the agreement was concluded, the public bid announced, or a controlling interest was acquired before 12 July 2023 are not covered by the FSR.

The notification obligation is applicable as of 12 October 2023. Notifiable concentrations for which the conclusion of the agreement, the public bid announced, or the acquisition of a controlling interest takes place on or after 12 July 2023, which are not closed before 12 October 2023, will have to be notified. If a transaction which is signed after 12 July 2023 risks not being closed before 12 October, a notification should be prepared.

The Commission may decide to open an ex officio investigation already as of 12 July 2023, in which case it can investigate foreign subsidies granted as far back as 12 July 2018. There are indications that a number of EU companies are in the starting blocks to submit FSR complaints to the Commission. Such complaints could allow the Commission to open an ex officio investigation.

What do we know so far in terms of required information?

The Commission has published a draft implementing regulation setting out procedural provisions and draft notification forms for procedures pursuant to the FSR. The draft is out for consultation until 6 March 2023 and the final version is to be adopted before 12 July 2023.

The draft implementing regulation unfortunately leaves most notions open to interpretation and provides very few practical limitations in terms of information and documentation that will have to be submitted. The Commission uses very broad terms. Below, we provide just a few indications of the requirements set out in the notification form for concentrations.

In line with the FSR, the notification form requires a notifying undertaking to provide a detailed list of all non-EU financial contributions which have been granted in the three years prior to the conclusion of the agreement, the announcement of the public bid or the acquisition of a controlling interest.

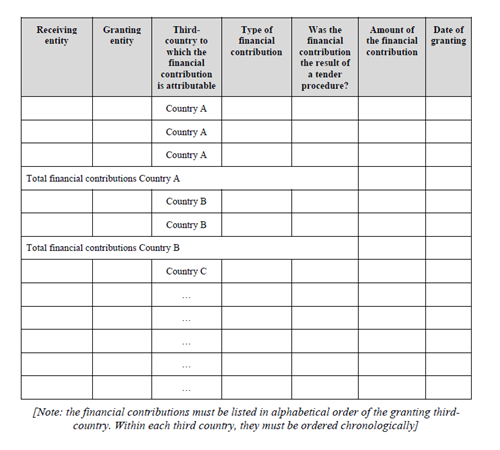

The information required is very detailed. For example, for each financial contribution it is required to set out the receiving entity, the granting entity, the granting country, the type of financial contribution, if it was the result of a tender, the amount of the contribution and the granting date, as well as if it has a link to the concentration and, if so, what that link is. For financial contributions that may fall within a category of foreign subsidies that are considered most likely to distort the internal market (e.g. unlimited guarantees, export financing measures and subsidies directly affecting a concentration), the main elements and characteristics must be even further specified (e.g. form of contribution, purpose and economic rationale, conditions attached, etc.).

While financial contributions below EUR 200,000 and total contributions per country and year below EUR 4 million are not required to be disclosed in the notification, such financial contribution could be caught in case of an ex officio investigation and should therefore still be monitored. This of course risks adding to the already significant administrative challenges.

As to the impact on the internal market, for example, if a structured bidding process is carried out, the notification shall include a detailed description of the process, including number of other candidates contacted, and how many expressed an interest, their profile, etc. Further, due diligence will have to be described and a copy of the reports submitted.

Nevertheless, the draft notification form does provide for the possibility for a notifying party to request a waiver from the obligation to provide information if it is not reasonably available to the notifying party in part or in whole. According to the draft notification form, such a request must be made in the form during the pre-notification discussions.

With regard to the information required, it is clear that undertakings are facing a very burdensome administrative exercise, monitoring and gathering information and documentation potentially relevant to future FSR proceedings. The FSR will thus have important implications for current and future deal planning (e.g. transaction timeline, including preparation time, duration of pre-notification and time required for a notification to be considered complete). It will also be necessary to consider liability clauses, conditions precedent and provisions on risk-sharing.

Risks with not respecting the FSR

If a transaction must be notified, the Commission’s approval is required prior to closing. Although the Commission might be a bit more lenient in the beginning, the FSR provides for fines of up to 1 % of aggregate turnover in the preceding year for incorrect or misleading information, and up to 10 % of aggregate turnover for failure to notify a notifiable concentration.

Should you have any questions or wish to discuss, please feel free to contact Martin Johansson, Hedvig Josefson or Sam Fakhraie Ardekani.

Does your company or any entity of your corporate group interact with public authorities in third countries or public or private entities whose action can be attributed to the third country; and is your company or corporate group likely to be involved in M&A transactions (potentially) triggering mandatory notification, or are your competitors likely to submit complaints to the Commission about you having received foreign subsidies? If the answer is yes, we advise you to set up a tracking system for continuous monitoring of non-EU financial contributions throughout your whole organisation.

For the purpose of potential notifications, the tracking system should list all financial contributions received after the 12 July 2020 of EUR 200,000 or more and indicate if these contributions exceed EUR 4 million per non-EU country per year.

Note that financial contributions of less than EUR 200,000 may be relevant in terms of the Commission’s ex officio investigations. Such investigations may be started in relation to foreign subsidies provided as of 12 July 2018. It may thus be of interest to track financial contributions also under EUR 200,000, received as of that date, if the Commission is likely to investigate any of your M&A transactions signed after 12 July 2023. With regard to such investigations, a foreign subsidy is not to be considered to distort competition if its total amount to an undertaking is below EUR 200,000 per non-EU country during a consecutive period of three years.

The tracking system should include, for each identified financial contribution, information on amount, granting date, receiving entity, granting entity, granting country, type of financial contribution, and if the financial contribution was the result of a tender (see below template provided in the Commission’s draft notification form).

Every entity should also include and highlight in the tracking system whether any of the non-EU financial contributions fall within the categories deemed most likely to distort the EU internal market, namely: aid to ailing undertakings, unlimited guarantees for debts or liabilities, export financing measures not officially supported by the OECD, subsidies directly facilitating a concentration.

The tracking system should be continuously updated, by all entities of your corporate group.

The tracking system should include descriptions of possible positive effects on the development of the relevant subsidised economic activity on the EU internal market, as well as broader positive effects on relevant policy objectives, in particular those of the EU. Specify when and where the positive effects have/are to take place.

In the context of notification of concentrations, there is a requirement to provide supporting documents relating to non-EU financial contributions falling within the high-risk categories (most likely to distort the EU internal market). This includes information on the form, purpose, economic rationale, granting authority, conditions attached, benefit conferred and selectivity of the contribution.

There is also a general requirement to provide documents (analyses, reports, studies, etc.) from the grantor or beneficiary, discussing the purpose and economic rationale of the contribution as well as possible positive effects.

The tracking system should, as relevant, include this information and sources to supportive documentation.

Template provided in the Commission’s draft notification form for concentrations.